35+ Mortgage calculator with fixed rate

That means the cash rate is now 135 per cent up from 085 per cent last month. 30 yr fixed mtg refi.

Lbc Mortgage Solutions Google Mortgage Rates Fixed Rate Mortgage Refinance Mortgage

Please keep in mind that the exact cost and monthly payment for your mortgage will vary depending its length and terms.

. A fixed rate makes it easier to budget for payments. Following are the definitions for the amortization calculator. The mortgage rate type can be fixed for the duration of the term or variable fluctuating with the prime rate.

Points-2-1 0 1 2. Most fixed-rate mortgages are for 15 20 or 30-year terms. A mortgage loan or simply mortgage ˈ m ɔːr ɡ ɪ dʒ in civil law jurisdicions known also as a hypothec loan is a loan used either by purchasers of real property to raise funds to buy real estate or by existing property owners to raise funds for any purpose while putting a lien on the property being mortgaged.

On July 1st 2020 the CMHC implemented new GDS and TDS limits for mortgages that it insured with the new GDS limit for CMHC-insured mortgages becoming 35 and the new TDS limit for CMHC-insured mortgages becoming 42. 15 year fixed. The annual percentage rate APR on a mortgage is a better indication of the true cost of a home loan than the mortgage interest rate by itself.

65897 66. The top paying six-month fixed rate bonds. To open this account a 1000 minimum deposit is needed.

Interest Rate - A fixed rate for your mortgage. The calculator works. Rates are influenced by the economy your credit score and loan type.

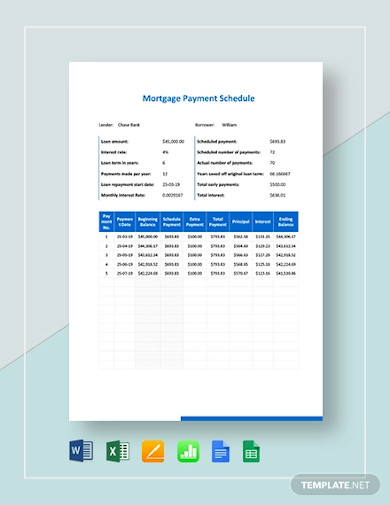

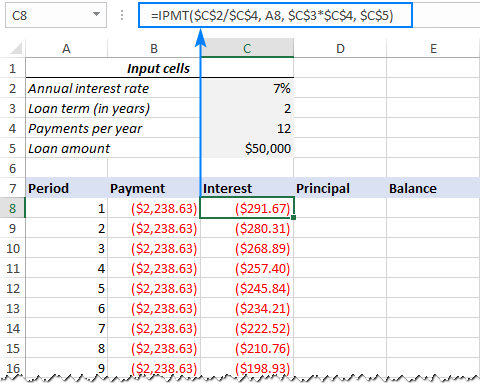

Loan Amount - Mortgage or the loan amount that you have or planning to apply. 30-Year Fixed-Rate Mortgage Loan Amount. Mortgage Calculator excel spreadsheet is an advanced mortgage calculator with PMI taxes and insurance monthly and bi-weekly payments and multiple extra payments options to calculate your mortgage payments.

Monthly Capital Interest Payment Breakdown. A tracker mortgage is a type of mortgage that follows the movements of other rates the most common of which is the Bank of England base rate. Total Mortgage Payment -Get rate -Get rate -Get rate -Get rate.

The average mortgage interest rate is around 55 for a 30-year fixed mortgage. First Payment Date - Select a start date for your mortgage. Calculating the Break-Even Point.

A 15-year fixed-rate mortgage has a higher monthly payment because you. The Reserve Bank of Australia RBA has increased interest rates by 05 percentage points. 30-Year Fixed-Rate Mortgage Loan Amount.

To estimate your break-even point more easily you can use the above calculator. Fixed rates are most popular in Canada and represent 66 of all mortgages according to the Canadian Association of Accredited Mortgage Professionals CAAMP. The mortgages are aggregated and sold to a group of individuals a government agency or investment bank that securitizes or packages the loans together into a security that investors can buyBonds securitizing mortgages are usually.

A mortgage-backed security MBS is a type of asset-backed security an instrument which is secured by a mortgage or collection of mortgages. Across the United States 88 of home buyers finance their purchases with a mortgage. To use our mortgage calculator slide the adjusters to fit your financial situation.

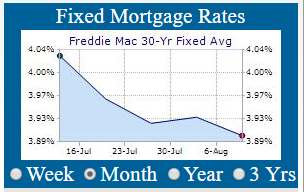

Fixed-rate mortgages rates are set for the whole term of your. Thirty-year fixed-rate mortgages cracked the 6 mark this week the first time this has happened since November 2008 As reported by Freddie Mac the average offered interest rate for a conforming 30-year fixed-rate mortgage increased another 13. The loan is secured on the borrowers property through a process.

This is our basic monthly mortgage payment calculator with an amortization table included. The Mortgage Calculator helps estimate the monthly payment due along with other financial costs associated with mortgages. Our mortgage calculator uses these maximum limits to estimate affordability.

The MND Rate Index is the best way to follow day-to-day movement in mortgage rates. Unlike mortgage rate surveys our index is driven by real-time changes in actual lender rate sheets. It will quickly estimate.

Because of this many consumers find fixed. Assuming you have a 20 down payment 30000 your total mortgage on a 150000 home would be 120000For a 30-year fixed mortgage with a 35 interest rate you would be looking at a 539 monthly payment. If after using the maximum mortgage calculator you find that you have a mortgage value lower than what you would have liked do not fret.

It must be opened online but once opened. Use our comprehensive online mortgage calculator which shows the monthly interest only and repayment amounts on a mortgage. The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term.

Required Income Calculator for a Mortgage Calculator. There are many mortgage loan products requiring deposits of 5 or less of the property value though it can change accordingly with market conditions. Across the United States 88 of home buyers finance their purchases with a mortgage.

Mortgage Details Original Loan. A shorter period such as 15 or 20 years. There are options to include extra payments or annual percentage increases of common mortgage-related expenses.

The 15-year fixed-rate mortgage is the second most popular home loan choice among Americans with 6 of borrowers choosing a 15-year loan term. There are a few ways you can improve your mortgage amount. In recent years standard variable rates have been on the rise.

The next best six-month bond rate comes from Zenith Bank UK Ltd which pays 135 gross on maturity on its Raisin UK 6 Month Fixed Term Deposit. They include making a larger down payment making smarter decisions as to the neighborhood where you are looking to buy from and trying to reduce. Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan.

Of those people who finance a purchase nearly 90 of them opt for a 30-year fixed rate loan. Use SmartAssets free Texas mortgage loan calculator to determine your monthly payments including PMI homeowners insurance taxes interest and more. Loan Terms - You can enter a 30 year 15 year or any other term for your loan.

A fixed rate mortgage has a rate of interest which doesnt change for a set period of time so you know exactly how much you pay every month. Required Income This mortgage calculator makes it easy to see how changes in the mortgage rate or the loan amount affect the income required for a loan. The APR takes into account not only the mortgage rate but also things like closing costs discount points and other fees that are charged as part of the loan.

Top rate available on a six-month fixed rate bond.

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Mortgage Interest Deduction Homeowners Biggest Tax Perk Hgtv

Create A Loan Amortization Schedule In Excel With Extra Payments If Needed

Adjustable Rate Mortgage What Is It And How Does It Work

How Much Should You Spend On That Life And My Finances

11 Mortgage Payment Schedule Templates In Google Docs Pdf Ms Word Pages Ms Excel Google Sheets Numbers Free Premium Templates

2

Kenya Silver Ceramic Wall Tile 8 X 24 In Banheiros Pequenos Modernos Banheiro Pequeno Casas

I D Like To Learn The Math Behind Mortgage Interest Rates Where Should I Start Yes There Are Calculators But I D Like To To Learn How To Calculate The Interest Amounts Myself So

45 Best Startup Budget Templates Free Business Legal Templates

I M 35 How Much Money Should I Have Saved For Retirement Quora

Tbd Round Mountain Road Almont Co 81210 Compass

Refinance Mortgage Lenders Az Sun American Mortgage

Current Fixed Mortgages Rates 30 Year Fixed Mortgage Rates

Borrow Wise Loans

Why Is It Smart To Start Saving For Retirement When You Re In Your 30s Quora